Enacted in November 2021, the Infrastructure Investment and Jobs Act (IIJA) allocates nearly $350 billion for federal highway and bridge funding over five years (2022-2026). Now, at its midpoint, amid challenges like supply chain disruptions and rising costs, the IIJA's impact has our industry seeing record levels of highway and bridge construction. Substantial increases in funding have led to notable market growth, and with most of the funding from the IIJA still on the table, contractors have significant opportunities to enhance profitability.

5 Key IIJA Highlights:

1. Largest Funding Increase Since the 1950s

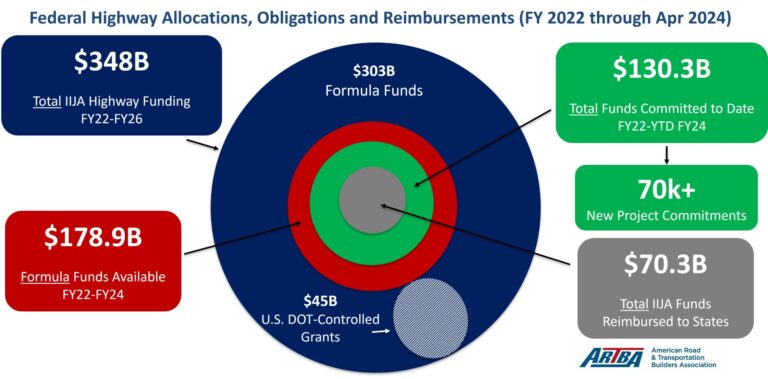

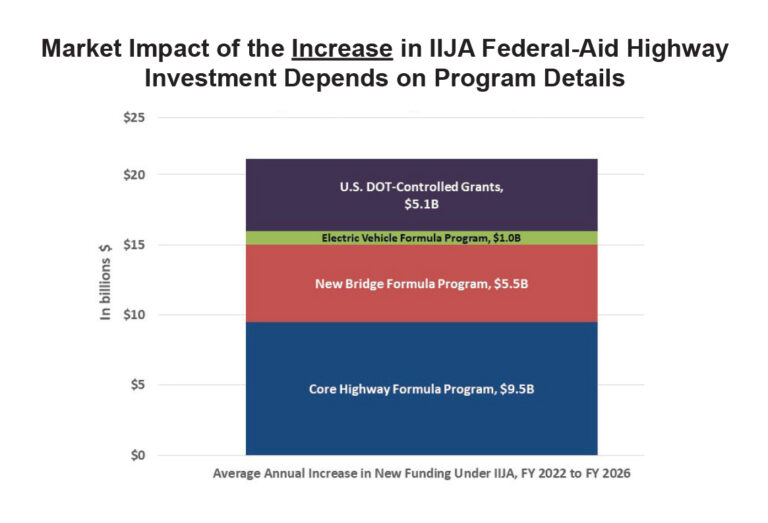

The IIJA provides $303 billion in formula funds and $45 billion in U.S. Department of Transportation (DOT) controlled grants. An initial funding increase of about 40% occurred in 2022, making it one of the largest increases in U.S. history. In fact, we haven’t seen an annual increase like this since the late 1950s after President Dwight D. Eisenhower signed the passage of the Federal-Aid Highway Act (National Interstate and Defense Highways Act), which authorized the construction of the interstate highway system.

2. Bridge Formula Program & Additional Funds

This new program under the IIJA accounts for an additional $5.5 billion (26%) of the average $21 billion funding increase. Because each state has four years to obligate funding from these programs, the speed of obligations from this program has been much slower. As we cross the halfway mark of the IIJA, only $7 billion of the $16 billion in available bridge formula funds have been designated.

3. 80% of All Available Funding Remains to Be Spent

As of April 2024, approximately $130 billion of total IIJA funds are under commitment, equating to 73% of available formula funds through 2024 and 37% of total funds through 2026. About $70 billion (54%) of this obligated funding was reimbursed to states.

At the IIJA halfway point, nearly 80% of all available funding through 2026 remains to be spent.

To this point, most obligations and outlays are from core highway formula funds, which are driving significant growth since those funds enter the market quickly. However, discretionary funds and programs, like the Bridge Formula Program, have seen slower obligation rates and a longer-term impact.

4. Highway & Bridge Contracts Hit Record Levels

The IIJA has led to more than 70,000 new federal-aid highway project commitments. At the local and state levels, typical growth rates for the value and number of highway and bridge contracts awarded are about 4% and 1%, respectively. In 2023, the value and number rose 36% and 18%, respectively, compared to 2021.

5. Value Put in Place (VPIP)

Typical growth in the Value Put in Place (VPIP) for highways and bridges averages about 4% annually. However, VPIP increased by 10% in 2022 and 18% in 2023. The ongoing expenditure of IIJA funds is anticipated to further boost construction activity throughout its duration.

Plenty of Optimism for Our Industry

Moving forward, the Infrastructure Investment and Jobs Act has positively impacted the future of highway and bridge construction, driving record growth despite ongoing economic challenges. With nearly 80% of the funding still available to be spent, the potential for construction activity in the coming years remains robust.

If you want more information on the impact of IIJA, please visit the American Road & Transportation Builders Association (ARTBA) website here.